The M&A team at Lauletta Birnbaum successfully closed another deal for one of our clients, PGFM Solutions, who provide engineering services and cybersecurity support for the United States Navy and Coast Guard. Read the full press release here.

The M&A team at Lauletta Birnbaum successfully closed another deal for one of our clients, PGFM Solutions, who provide engineering services and cybersecurity support for the United States Navy and Coast Guard. Read the full press release here.

LB’s own Rich DeMarco is the coordinator and chairman of a comprehensive Continuing Legal Education seminar called “Understanding Philadelphia Zoning” which will take place next month at the CLE Conference Center downtown. The four hour course will cover all aspects of the Philadelphia Zoning process, including how to present in front of the Zoning Board, submit an application at Licenses & Inspections, and handle opposition from the community. To register for the course or learn more about it, click here.

Frank Lauletta and Randy Ford attended iPipeline’s annual user conference, Connections in Las Vegas last weekend. Randy Ford spoke on a panel that focused on threats and legal responsibilities for insurance carriers and broker-dealers in the areas of cyber-security and fraud. Ford was joined by iPipeline’s COO/CFO, Larry Berran, and Carrie Folger, Assistant Vice President of Relationship Management at Protective Life. This is the third year that Lauletta Birnbaum presented at Connections.

Lauletta Birnbaum represented iPipeline® in its recent acquisition of BlueSun Inc., a Canadian-based software company that provides solutions to the life insurance and financial services industry. Since they began working together in 2008, the firm has closed seven acquisition deals on iPipeline’s behalf. Lead attorneys on the deal were Frank Lauletta and Randy Ford, while Lauren Hough, Max Perricone, and David Hollander provided integral support.

Read the full release from iPipeline here.

The New Jersey Economic Development Authority announced last week that Incutate, which was founded by Lauletta Birnbaum in 2011, has been added to their list of approved coworking spaces as part of their NJ Ignite program. The NJEDA launched NJ Ignite with the goal of providing financial support for start-up and small businesses throughout the Garden State. Read more about Incutate and NJ Ignite here.

Lauletta Birnbaum represented client Main Line Equity Partners in its recent Growth Investment in American Box & Recycling Company. Philadelphia-based American Box, one of the nation’s largest suppliers of once-used boxes, has been family owned and operated for over 50 years. This strategic investment by Main Line will help American Box further its mission to help customers achieve “zero waste” sustainability. Read more about the deal here.

Six Degrees of Bishop Eustace: High School Alumni Turned Law Partners

Several Lauletta Birnbaum attorneys were featured in the Fall 2018 issue of Bishop Eustace Preparatory School’s magazine, Tradition, for their ties to the high school. Check out the full article here.

By: Frank Lauletta

The Tax Cuts and Jobs Act of 2017 was enacted on December 22, 2017. The Act included Internal Revenue Code §1400Z, which provides tax incentives for investments in qualified Opportunity Zones through investment vehicles called Qualified Opportunity Funds. These funds are designed to encourage investments into low-income communities, which are designated by the state as Qualified Opportunity Zones.

The number of Qualified Opportunity Zones may equal up to 25 percent of the number of low-income communities within that state. However, if there are less than 100 low income communities, then a total of 25 tracts may be designated as Qualified Opportunity Zones. Up to five percent of the tracts designated in a State may be non-low-income communities if the tract is both contiguous with the low-income community and the median family income of the tract does not exceed 125 percent of the median family income of the low-income community. In New Jersey, there are 169 opportunity zones, which in southern New Jersey include Camden, Deptford, Woodbury, Lindenwold, Pine Hill, Carneys Point, Egg Harbor City, Glassboro, Salem, Vineland, Egg Harbor Township, Bridgeton, Millville, Pleasantville, Atlantic City, Somers Point, Lower Township and Wildwood.[1]

If an investor realizes a gain from a sale or exchange of a capital asset from an unrelated party, the investor may defer realization and taxation if, within 180 days from the date of such sale or exchange, the investor reinvests the gain amount with a cash investment into a Qualified Opportunity Fund. A Qualified Opportunity Fund is an investment vehicle that must hold at least 90 percent of its assets in designated Qualified Opportunity Zone properties. Opportunity zone property means property which is an opportunity zone stock, an opportunity zone partnership interest, or an opportunity zone business property. A qualified opportunity zone business property means tangible property used in a trade or business if (i) such property is acquired after December 31, 2017, (ii) the fund substantially improves [2] the property, and (iii) substantially all of the use of the property is in a Qualified Opportunity Zone.

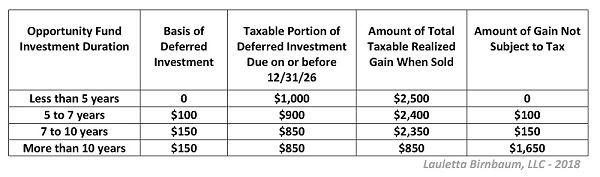

The tax advantages are three-fold. First, the tax that would otherwise be payable in connection with the sale of the prior capital asset is deferred until either the date the opportunity investment is sold or exchanged or December 31, 2026, whichever date comes first. As part of the deferral, the basis assigned to the replacement Qualified Opportunity Zone property starts at $0. However, the second advantage allows this basis to increase based upon the duration of the investment in the Qualified Opportunity Fund. If the investment is held for at least 5 years, the basis will increase by 10 percent of the amount of gain deferred. If the investment is held for at least 7 years, the basis will increase an additional 5 percent or 15 percent of the deferred amount in total.

The amount to be included will be the lesser of the deferred amount or the fair market value (if a “loss” is taken) minus the taxpayer’s basis, shown above. The applicable taxes due on the deferred investment will be due no later than December 31, 2026. This date is a hard deadline and is essential for investors to take full advantage of the tax break. Therefore, to be awarded the full 10 percent break, the investment must be paid into the fund by 2021. Respectively for the additional 5 percent, the investment must be in the fund by 2019.

The third tax advantage is realized if the taxpayer holds Opportunity Zone Property in the Opportunity Fund for at least 10 years. If this is the case, then the basis of the Opportunity Zone Property will be the fair market value on the date it is sold. This means that no additional capital gains tax, beyond what is due on December 31, 2026, will be due when the taxpayer sells the Opportunity Zone Property.

Example:

Deferral of Gain Invested in Opportunity Zone Property = $1,000

Fair Market Value of Opportunity Zone Property = $2,500

For more information about this new law, call Frank Lauletta or Lloyd Birnbaum at 856-232-1600.

[1] The following link contains a map of the New Jersey Designated Opportunity Zones:

https://www.state.nj.us/dca/divisions/lps/pdf/Statewide_Designated_Opportunity_Zones_Map.pdf

[2] “Substantially improves” means that the investor must invest an amount equal to or greater than the cost to initially acquire the property. In other words, at least 50% of the total investment amount must be used toward improving the property.

Members of the Lauletta Birnbaum Family had fun casting for a cause over the weekend at The Ike Foundation’s Celebrity Pro-Am Bass Fishing Tournament. The Ike Foundation was founded by Mike Iaconelli of Professional Edge Fishing, a client of the firm. The organization aims to get kids involved with fishing at while they are young. By “hooking ’em early”, The Ike Foundation hopes to promote a positive hobby and appreciation for the outdoors. The firm is proud to sponsor the foundation, which assists civic organizations, existing youth fishing organizations, and other charitable organizations in sponsoring events and functions which promote fishing to both inner-city and rural youth.

Lauletta Birnbaum’s co-working facility, Incutate, LLC is expanding its Southern New Jersey Headquarters to better serve the needs of start-up and emerging growth companies. Read the full press release here.